Download the H2OXSignals 2023-2024 Season Outlook.

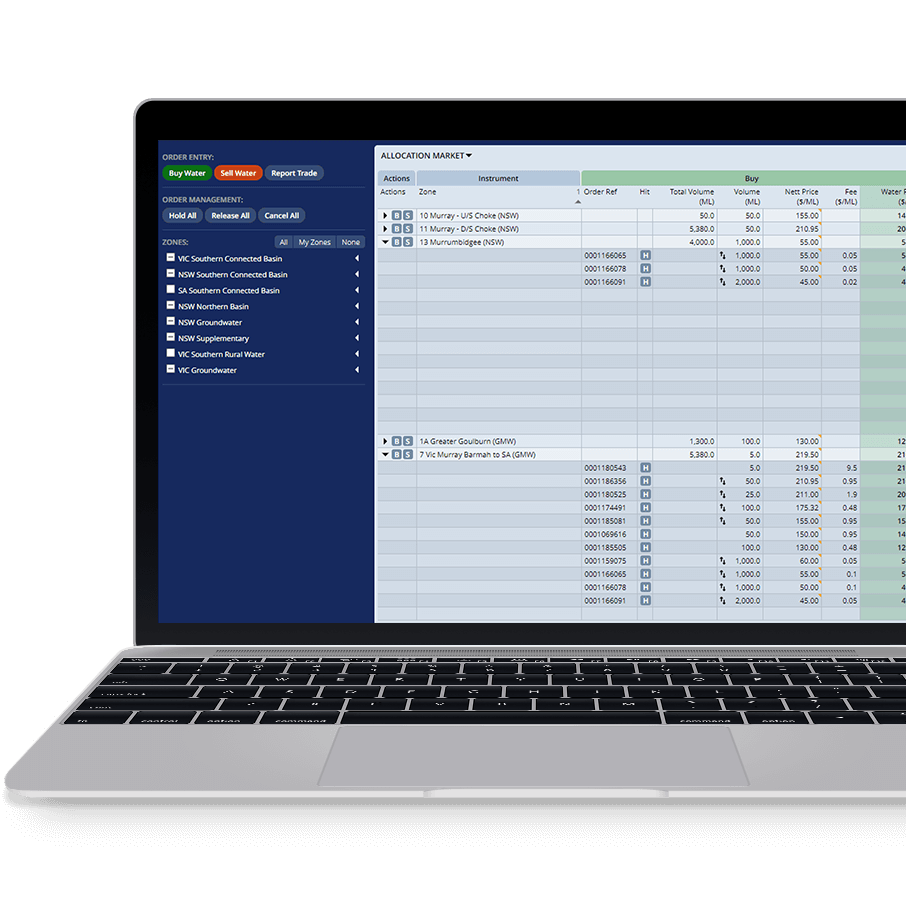

H2OX is your market for water, when and where you need it. Purpose built for trading water, H2OX is an efficient, transparent source for buying and selling the world’s most precious resource.

Learn More

The H2OX App makes it easy to access your water market—anytime, anywhere. The multi-language, conversational interface lets you talk, text, or tap to access markets and initiate trades, just like on the desktop platform.

The H2OX App is another step in our mission to provide a level playing field for all market participants, offering live bids and offers for water, complete price transparency, full order management, and the same fixed-fee structure for all transactions.

Download

H2OX’s transparent trading platform is easy to use, streamlining the process of securing the water you need to thrive. H2OX is not a broker—we do not trade or hold any water licenses—which means we have no conflict of interest.

Get Started